So many exciting options out there, with ride share apps, and self driving cars evolving, who even thinks humans will be driving at all in 10 or 15 years? There may be better cost effective options soon…..but in the mean time, over 90% of US households DO have a car, it’s kinda key for daily transportation….for the moment. If I’m completely honest, my car is actually a personalized sound booth, where I sound amaaaaaaazing belting out fabulous music. For some odd reason I never sound as good to other people. The singing is awkward in a Lyft, so I’m happy to have my mean driving machine.

But how do you make this monthly spend jive with your ambitions to be wealthy? A car will most likely be the 2nd most expensive thing you buy – after a house – and the MOST expensive if you don’t have a house. Should you lease or buy, which is the better choice? Ideally, you want to spend no more than 10% of your salary on a car payment + insurance. So if you make $35K/year, or $2900/month before taxes, you want to cap that at $290.

Most of us make our car buying decision by the monthly payment – can I afford it. Of course that’s a key factor in your car buying – but if you went to a restaurant and they said you can pay $30 now for your meal, or you can pay $4/month for the year, you’d look at them like crazy people for asking you to pay $48 ($4 x 12 mos) for your $30 meal. Same fundamental idea with cars, you don’t want to pay $48K for a $30K car. But of course it’s harder to have $30K in your pocket, vs $30 for a meal. So we have to look at the options – but let’s remember not to be overly impressed by the monthly payment alone.

I decided to look at the average price for a 2019 car, and what are the best selling cars, and I learned that trucks – pickup trucks – are pretty much always the best selling vehicles (here are the best sellers in 2018, if interested). Makes sense, for work trucks, but for the rest of our daily lives, currently the best selling cars are “crossovers”, or the SUV-esque cars that are bigger than a sedan, smaller than a suburban – cars like the Toyota Rav4, Honda CRV, Nissan Rogue, and Chevy Equinox. Price? Each of those sell for about $26,000 for the base 2019 model.

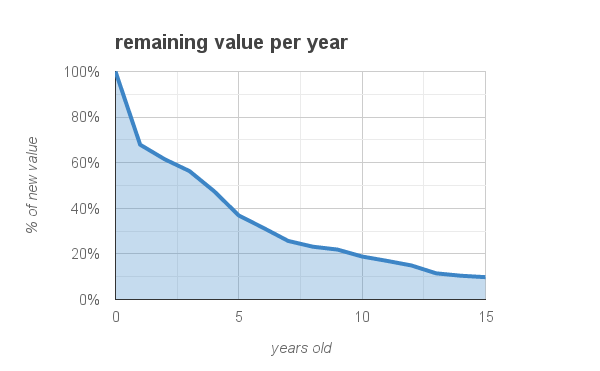

As you’ve probably heard, cars are depreciating assets – the value of it only ever goes down. On average, in the first year, cars depreciate about 30%. In the second year, another 7-10%, and another 5-7% in the 3rd year. So after 3 years, a car has lost about 45% of it’s value. This cool webpage at Kelly Blue Book actually tells you which cars hold their value the best. For those crossover cars, they hold about 55% of their value – which means they LOOSE 45% – so the $26K car is worth about $14,300 after 3 years.

What the heck does that mean for you buying a car? Let’s chat about lease vs. purchase. When you BUY the car, you own that asset, even though it’s losing value all the time (unlike houses, which hold value differently). When you LEASE a car, you basically just rent it, you never own the asset.

Therefore, when you lease a car, you ONLY pay the depreciation on the car – the car company estimates your payments based on that depreciation. As we said, a $26,000 car is worth $14,300 after 3 years, so if you did a 36 month lease, you’d pay the difference in value (the depreciation), which is $11,700. Of course, we are talking cars, so can negotiate the initial price (that $26K), and you can negotiate your down payment, especially if you have good credit (This Edmunds article gives some nice examples of different down payments).

For our math, let’s say you do $0 down payment, then it’s just $325/month – which is $11,700 divided by 36 months. Off you go! You’ve rented a car for 3 years, with many lease advantages:

- You get a new car every 36 months – which means the newest technology, and it’s lookin’ good.

- You get the new car warranty, so you don’t pay for repairs, or usually even oil changes.

- You don’t have to be approved for a car loan, as they just take the car back if you stop paying – it’s really never yours.

- Your monthly payments are lower than when you buy, since you’re only paying for the depreciation during that time, not the full value of the car.

Allrighty then, so why would you buy a car? When you actually own it, it’s your asset, and once you pay it off, you can get to a point where you have NO monthly car payment – never possible with a lease. You’ll always have a car payment when leasing – think what you can do with that money instead! When you own it, you can also SELL it at any time, and make money on the sale. With a lease, the car has to stay in perfect condition (or you pay a penalty), and you a cap on how many miles you drive (or pay a penalty), as those factors determine the car value at the end of your lease. When you own it, it’s yours, do whatever you want, drive across the country, cover it with bumper stickers, paint the side mirrors pink. Whatevs, it’s yours.

Now the math of buying. Leases have become more popular – almost 30% of new car seekers lease – because it turns out, most people don’t have $26,000 lying around. So to buy, most people need a loan – so you’re going to pay $26K plus interest over the time it takes you to pay for it. Your down payment will be bigger, because the dealer does need to know your skin is in the game, that you’ll keep paying monthly because you don’t want to lose the down payment.

How much does that mean we pay? If you choose to BUY your car over 36 months, the same time frame we talked about leasing, OF COURSE you will pay more, because you’re going to pay the FULL value. So normally the down payment is about 20% down, or $5200. With a loan at 2.5% interest, then you’ll pay $600/month for 3 years. In total, including interest, you will have paid $26,800 for that car. (Ideally you never want to finance for more than 48 months – the interest just gets silly – remember that $30 meal?).

So for a lease you’d pay $325/month with nothing down, and to buy it you’d pay $600/monthly, AFTER paying $5200 down?? Why would anyone do this?

Again, we don’t want to ONLY look at the monthly payment. Let’s look at the whole picture.

- With the lease, 3 years you pay $375/month, or $11,700 total. At the end, you have NO car, and start again with a new car payment.

- With the purchase, you paid out $26,800 for that car. But at the end of 36 months, you now fully own that asset, which as we said when calculating the lease, is worth $14,300.

- If you SOLD that car right away, and made $14,300, you actually are in the same place financially, less $800 you paid in interest. So in that way – it’s the same! Just more steps to finance the buy, and to sell it.

If the two are the same after 3 years, why wouldn’t you just lease?? The next step shows where buying is a benefit. If you keep your car 2 more years, you now have $0 monthly payments – it’s paid off! Free driving! After 5 years, cars still hold about 40% of their value. So you could have 2 years of paying nothing, then still sell it for about $10,000 (~40% of the original $26K). Do the math again:

- We originally paid $26,800

- Made back the selling price of $10,000 after 5 years

- $16,800 total paid divided by 60 months….that is actually a monthly price of $280 – that’s 25% less than the lease price!

- You paid $16,800 net in 5 years, where if you did 60 months of a lease at $375, that’s $22,500. You could have saved $5700.

Now, let’s be honest, we’re counting different apples – with the purchase, you had to finance your purchase, you had to keep it 5 years, so there may have been some costs for new tires, or other maintenance, and then you had to sell it – all hassles vs the ease of leasing. But how often do you stumble across $5700 in savings? It’s worth considering.

If you want to be really thoughtful with your pennies, and can tolerate a used car, the savings goes even further! Yippee! Remember we said in its first year the car loses 30% of it’s value? So if you bought a 2018 model used, the price should be somewhere in the $18K range. (And you’d probably still have 2 years on the manufacturer’s warranty, bonus.) The math for buying an $18K car?

- Pay 20% down, or $3600

- A 2.5% loan for 36 months means you pay $416/month…..then pay nothing for 1 more year

- Sell it at 60 months of age (from the car’s birth, you only have had it 4 years) for $10,000

- Total spend of $18,600 ($18K to buy, $600 interest) less $10,000 = $8,600 net total spend

- $8,600 divided by 48 months? That’s $180/month average! Less than half the cost of leasing a new car for $375.

- Total spend of $8,600 buying used vs $18,000 leasing ($375 x 48mos) saves you $9,400.

That was a LOT of math. Still awake? Did you see the point in all this? Leasing is easy and convenient, and if you think you should have a new car every 3 years, you may have a lower monthly cost vs buying. But as a way to use your money, it’s not the best. You could save money buying a used car, or buying new and keeping it longer than the payment term…..and invest what you save to keep walking down that path toward wealth! Financial independence is our goal! Tell me what you think in the comments, would you rather lease, forget all the math? Are you mildly tempted to buy used now? Even mildly? Or will you just wait to ride share everywhere?

Thank you for breaking this down for us! I always buy used but have been tempted to lease for the fanciness factor. Love your blog, you make this all so simple to understand!

You rock Shannon. 3:52am, huh?

Your site is very helpful. Many thanks for sharing!